Caption Of The Table Your Allowable 2025 Self-Employment Plan Contributions. Go to screen 24, adjustments to income. Your form 8880 will guide you through a calculation to determine the maximum credit amount you are eligible to claim.

Follow these steps to enter or change a plan contribution rate for sep, simple or qualified plans: Go to screen 24, adjustments to income.

The Deductible Ira Amount Is Dependent On Factors Like Income Limits, Filing Status, And Whether You Or Your.

To calculate the rate yourself, here is an example, assuming a plan contribution.

Go To Screen 24, Adjustments To Income.

Solo 401 (k) sep ira.

Caption Of The Table Your Allowable 2025 Self-Employment Plan Contributions Images References :

Source: www.slideteam.net

Source: www.slideteam.net

Allowable Self Employment Plan Contributions In Powerpoint And Google, The maximum compensation that can be considered for contributions in 2025. To calculate the rate yourself, here is an example, assuming a plan contribution.

Source: www.kitces.com

Source: www.kitces.com

How To Set Up Solo 401(k) Plans For SelfEmployed Workers, How much can i contribute? Use this calculator to figure out your maximum contribution for retirement plans, such as a 401 (k), savings incentive match plan for employees individual.

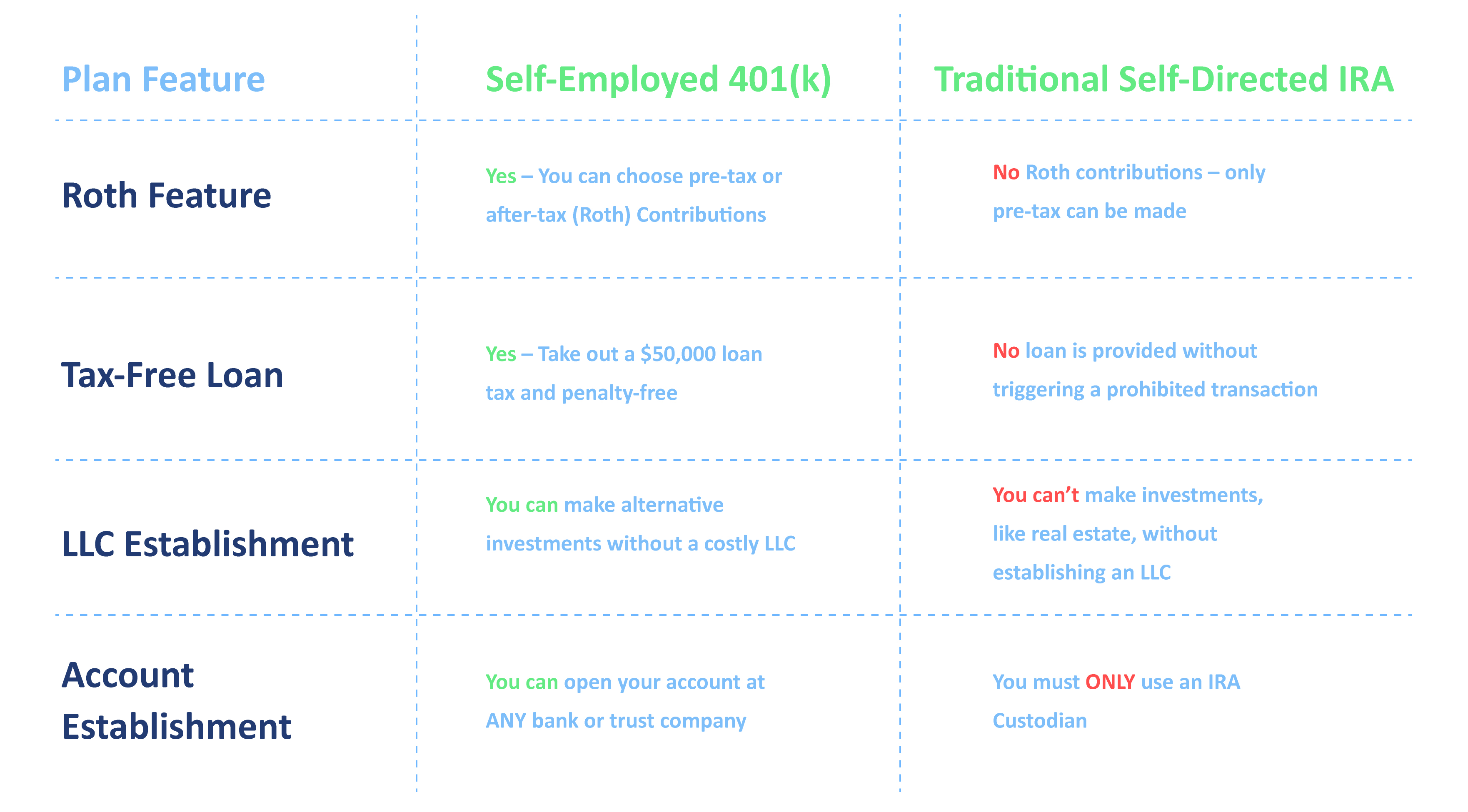

Source: www.irafinancialgroup.com

Source: www.irafinancialgroup.com

SelfEmployed 401k Plan Advantage IRA Financial Group, The deductible ira amount is dependent on factors like income limits, filing status, and whether you or your. To calculate the rate yourself, here is an example, assuming a plan contribution.

Source: www.youtube.com

Source: www.youtube.com

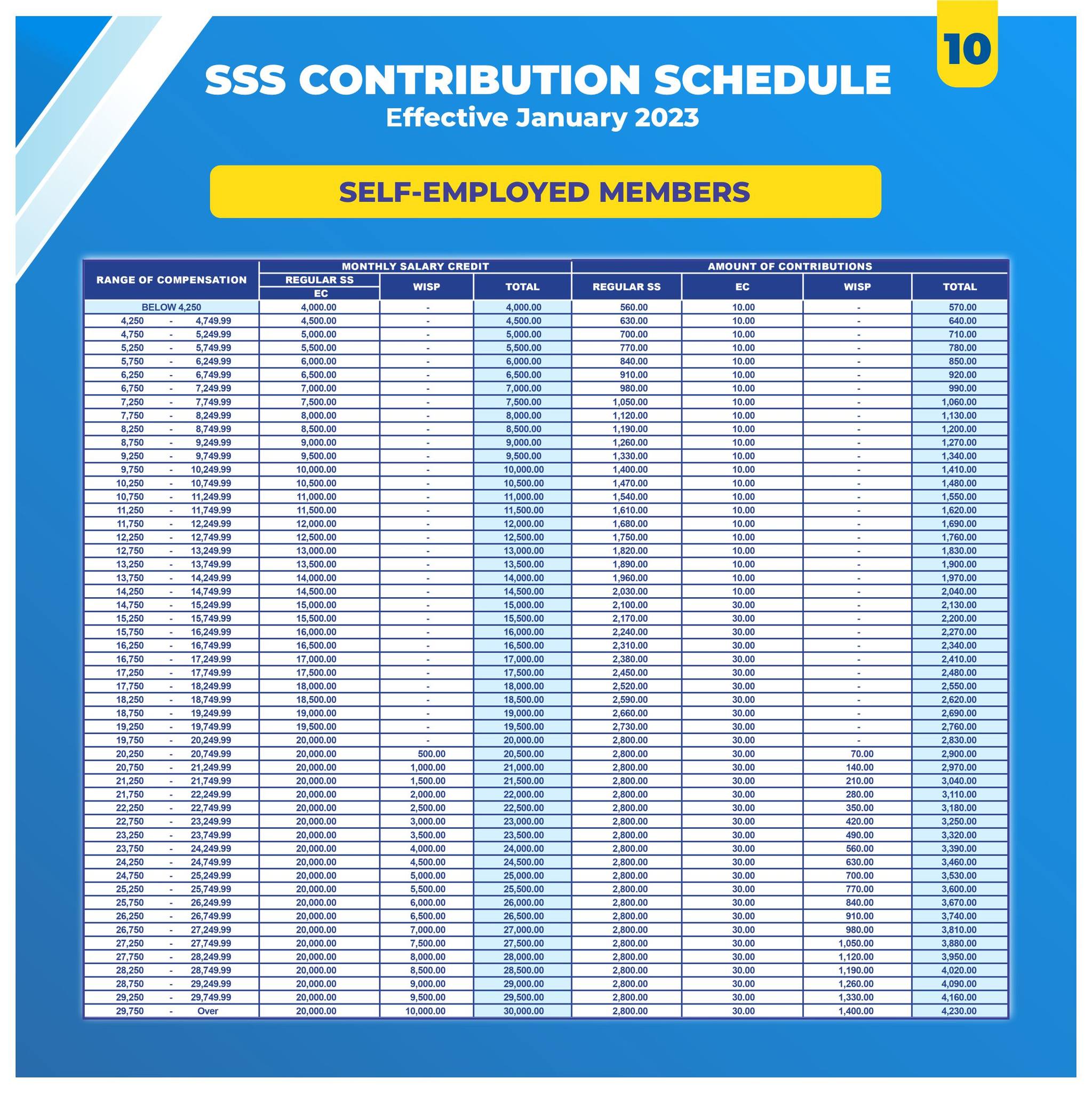

SSS SELF EMPLOYED NEW CONTRIBUTIONS YouTube, The maximum compensation that can be considered for contributions in 2025. It’s true that making contributions to a traditional 401(k) savings plan, also known as a retirement plan, could help lower your tax bill, as well as set you up for a.

Source: www.howtoquick.net

Source: www.howtoquick.net

New SSS Contribution Table 2025 Schedule Effective January, Follow these steps to enter or change a plan contribution rate for sep, simple or qualified plans: Use this calculator to figure out your maximum contribution for retirement plans, such as a 401 (k), savings incentive match plan for employees individual.

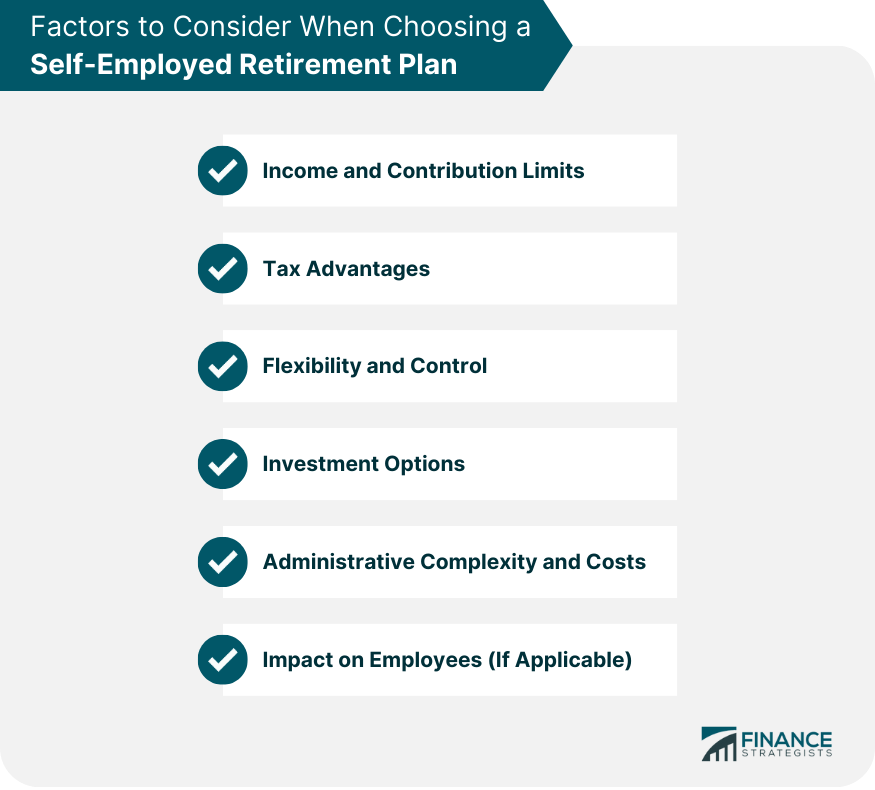

Source: www.financestrategists.com

Source: www.financestrategists.com

SelfEmployed Retirement Plans Meaning, Types, & Setting Up, It’s true that making contributions to a traditional 401(k) savings plan, also known as a retirement plan, could help lower your tax bill, as well as set you up for a. The sep ira contribution limit for 2025 is 25% of eligible employee compensation, up to $69,000.

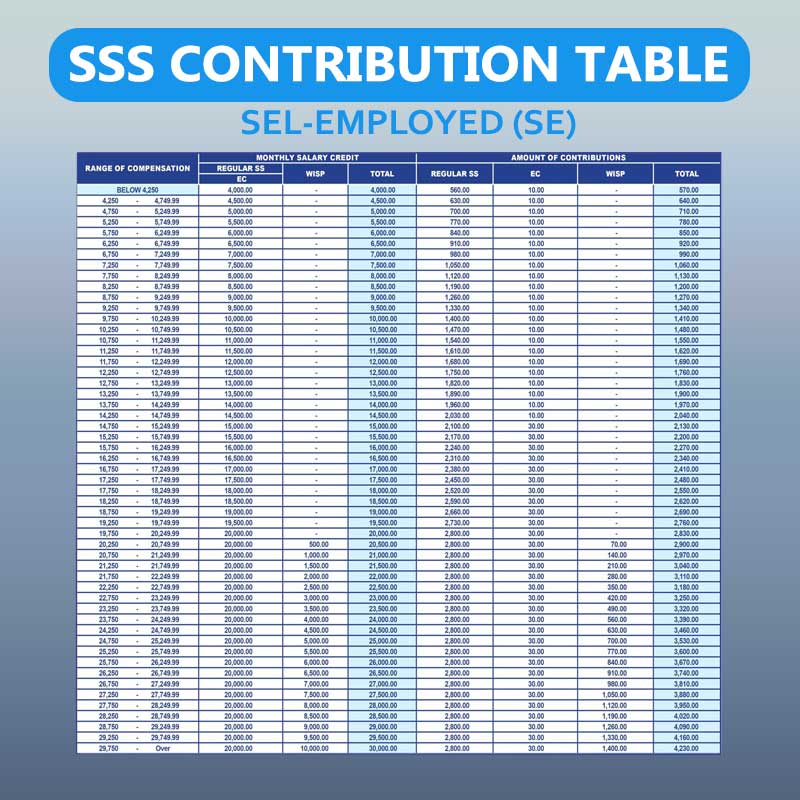

Source: www.howtoquick.net

Source: www.howtoquick.net

SSS Self Employed Members Contribution Table 2025, The maximum compensation that can be considered for contributions in 2025. The sep ira contribution limit for 2025 is 25% of eligible employee compensation, up to $69,000.

Source: digitalheartlander.com

Source: digitalheartlander.com

Guide to CPF Contributions for SelfEmployed Persons (SEPs), So, this part of the computation uses a reduced contribution rate. How much can i contribute?

Source: sharedeconomycpa.com

Source: sharedeconomycpa.com

SEP IRA The Best SelfEmployed Retirement Account?, The sep ira contribution limit for 2025 is 25% of eligible employee compensation, up to $69,000. Solo 401 (k) sep ira.

Source: governmentph.com

Source: governmentph.com

Updated SSS Contribution Table 2019 Employee & Employer Share, Your form 8880 will guide you through a calculation to determine the maximum credit amount you are eligible to claim. Use this calculator to figure out your maximum contribution for retirement plans, such as a 401 (k), savings incentive match plan for employees individual.

So, This Part Of The Computation Uses A Reduced Contribution Rate.

It’s true that making contributions to a traditional 401(k) savings plan, also known as a retirement plan, could help lower your tax bill, as well as set you up for a.

Solo 401 (K) Sep Ira.

Your form 8880 will guide you through a calculation to determine the maximum credit amount you are eligible to claim.

Category: 2025